The U.S. ended the de minimis exemption on August 29, 2025, meaning that no imported package—regardless of value—can enter duty‑free anymore (sources Reddit Printful Help Center Reuters).

Soooo, what in the world does that mean? For print‑on‑demand (POD) Shopify sellers, who often rely on overseas fulfillment, this change creates both risk and urgency.

With Q4 fast approaching—the most critical sales period of the year—it’s vital to pivot fast, reassess fulfillment strategies, and safeguard margins and customer trust.

This post explains the tariff changes, compares how Printful, Printify, and Gelato are affected, and offers a clear roadmap for POD sellers to navigate this disruption profitably.

Breaking News Update – Sept. 2025

A federal appeals court has ruled that most of the Trump administration’s global tariffs were illegal under the International Emergency Economic Powers Act (IEEPA). However, tariffs remain in place until at least October 14, 2025, while the administration appeals to the Supreme Court.

Key takeaways for POD sellers:

– Ruling: Court found the broad tariff program unlawful (AP News, Reuters).

– Short term: No changes yet—duties and shipping delays remain in effect through Q4.

– Possible relief: If the ruling is upheld, many tariffs could be lifted later this year, lowering landed costs. If overruled on appeal things could stay as is.

Seller action:

– Stick with domestic or local-first fulfillment (Printful U.S., Printify’s U.S. providers, Gelato’s regional partners). Safest bet for now.

– Keep duty-inclusive pricing in place now.

– Be ready to recalculate pricing and margins quickly if tariffs are rolled back.

What’s Changed: The U.S. Tariff Landscape

- End of de minimis exemption: As of August 29, 2025, packages previously exempt under the ~$800 threshold now face full customs duties Reuters.

- Massive duties on Chinese imports: Some goods from China now carry tariffs as high as 145%, and other countries face renewed or retaliatory tariffs CBP Rulings Do Dropshipping Reddit.

- Logistics upheaval: Postal services across Europe and Asia—including Royal Mail and Australia Post—have suspended U.S. shipments due to confusion over duty collection. Major carriers are adjusting, leading to delays Reuters.

- Merchant burden: Customs paperwork is increasing. Sellers can no longer rely on low-value exemptions and must plan for the full landed cost of each order.

Key takeaway: POD sellers must rethink fulfillment. Ignoring duties or delays in Q4 could be disastrous for margins and customer experience.

Why POD Sellers Stand to Lose — Unless They React

- Tight margins: Typical POD markups offer little room to absorb hefty duties—tariffs can annihilate profits.

- Hidden fees hurt conversions: Customers seeing unexpected customs fees at delivery often abandon carts or leave poor reviews.

- Country-of-origin matters more than shipping origin: Fulfillment centers may be local, but if blanks or components originate from China or other high-tariff regions, duties may still apply.

- Timing risk in Q4: Combined delays and costs during peak shopping season = lost orders and revenue.

Fulfillment Partners Compared:

Tariff Impact and Strategy

A. Printful

Fulfillment model: Owned in-house centers in U.S., Canada, Mexico, Spain, Latvia, U.K., plus partners in Japan, Brazil, and Australia Printful Help Center Reddit. They are used by the majority of Shopify print on demand sellers which is why we chose to launch promptink.ai with them as our fulfillment integration of choice.

Tariff exposure:

- Minimal for U.S. orders: Domestic fulfillment avoids import duties altogether.

- Global mitigation: Local production in EU and Canada sidesteps cross-border charges.

- Absorbing costs: Printful has not raised prices so far and absorbs some tariff-related expenses. It reserves the right to adjust—providing advance notice Printful Printful Help Center.

Considerations:

- Best for U.S.-based sellers targeting U.S. customers.

- Blanks from China may still trigger tariff impacts, but overall disruption is lower.

- Sellers should monitor carrier delays for orders fulfilled outside the U.S. Printful Help Center.

B. Printify

Fulfillment model: Network of third-party print providers across locations—including U.S., Canada, Mexico, EU, and China Printify.

Tariff exposure:

- Variable: U.S.-based providers = tariff-free; overseas providers (e.g., in China) = high risk.

- Price stability: Printify is not raising prices yet and is absorbing costs where possible.

- Shipping holds: Some international providers may have orders flagged as “On Hold” for U.S. delivery due to carrier disruptions Printify.

Considerations:

- Sellers must actively choose low-tariff providers.

- Tools like Printify Choice help automatically route to cost-effective providers, protecting margins and reducing customs risk Printify.

- Requires ongoing monitoring of provider status and order routing.

C. Gelato

Fulfillment model: Local-first network of over 140 production partners in 32+ countries Gelato Create.

Tariff exposure:

- Lowest risk: Local fulfillment avoids duties in major markets.

- DDP (Duty Delivered Paid): For U.S., EU, UK, Canada, Australia, Singapore, Gelato covers duties—customers pay nothing extra Printful Gelato Create.

- Potential downsides: Quality may vary by region; some products may still ship internationally (tariffs may apply).

Considerations:

- Ideal for brands with international customer bases and eco-conscious positioning.

- Sellers should verify print quality by region and ensure transparency about fulfillment location in product listings.

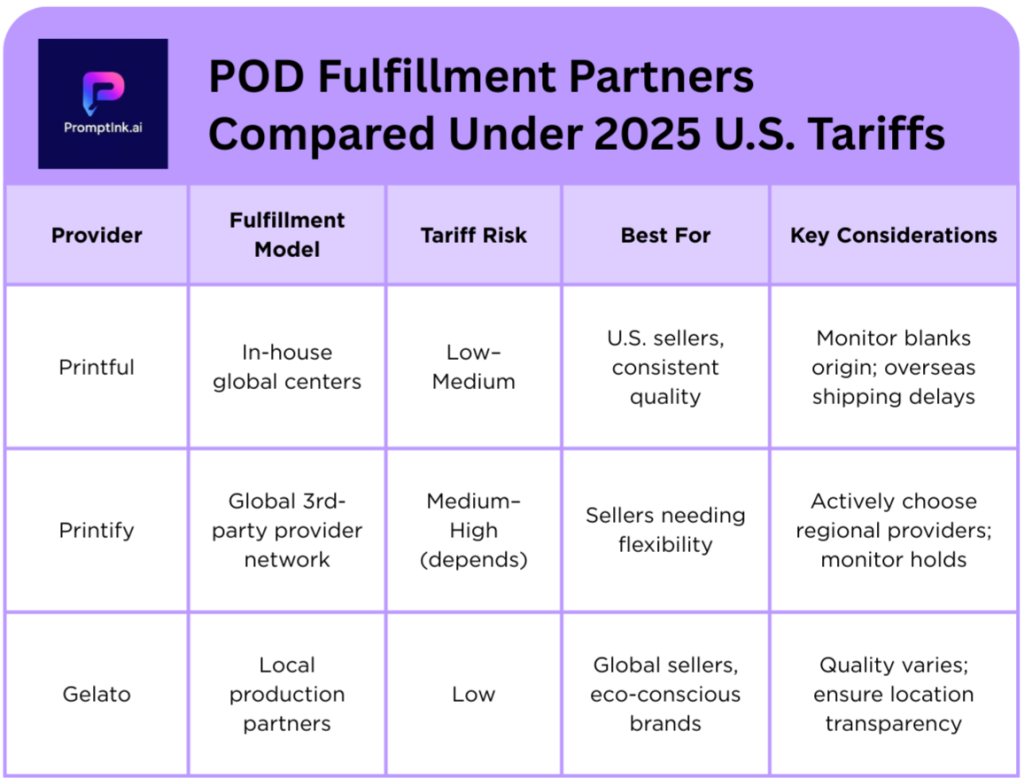

Summary Table

| Provider | Fulfillment Model | Tariff Risk | Best For | Key Considerations |

|---|---|---|---|---|

| Printful | In-house global centers | Low–Medium | U.S. sellers, consistent quality | Monitor blanks origin; overseas shipping delays |

| Printify | Global 3rd-party provider network | Medium–High (depends) | Sellers needing flexibility | Actively choose regional providers; monitor holds |

| Gelato | Local production partners | Low | Global sellers, eco-conscious brands | Quality varies; ensure location transparency |

4. Action Plan for Shopify POD Sellers (Q4 Ready)

1. Audit Your Product Origins & Fulfillment

- Confirm country of origin (COO) for blanks/components—not just fulfillment location.

- In Shopify, route orders strategically: Printful U.S. for U.S. buyers, Printify U.S. or Gelato local partners for rest of world.

2. Recalculate Landed Costs

- Build pricing that covers product, shipping, and duties.

- Consider “duty-included” pricing to avoid surprising customers.

3. Update Store Messaging and Shipping Info

- If duties may apply, clearly state “customs fees may apply” on product pages and FAQs.

- Emphasize DDP or duty-paid fulfillment where applicable (e.g., Gelato for U.S./EU).

4. Diversify Fulfillment Strategies

- Use hybrid approaches: e.g., Printful U.S. for North American orders, Gelato for EU/UK, Printify Choice for flexibility.

- Avoid dependency on any single shipping corridor or provider, especially during holiday peak.

5. Monitor Platform & Policy Changes

- Stay updated through Printful, Printify, and Gelato communications.

- Be ready to adjust provider choice or pricing if tariffs evolve.

Conclusion

The end of the de minimis exemption and renewed tariffs upend the old playbook for POD sellers. But by shifting to local production, duty-aware pricing, and strategic provider selection, Shopify stores can stay profitable and trustworthy into Q4 and beyond.

- Printful: Most stable, especially for U.S. orders, with cost absorption and global coverage.

- Printify: Flexible but requires active provider management and awareness of tariff/trade dynamics.

- Gelato: Safest for international fulfillment with DDP guarantees, best for global and eco-minded sellers.

Take action now: audit your supply chain, update pricing, sharpen shipping messaging, and diversify fulfillment to hedge against tariff shocks.

Your Q4 sales and customer satisfaction depend on it!

Leave a Reply